NEWS

Meti Corporate Finance acts as exclusive financial advisor to GC Holding S.p.A. for the placement of a minority stake (8.7%) in the Italian Sea Group S.p.A. through an accelerated bookbuilding

BACKGROUND

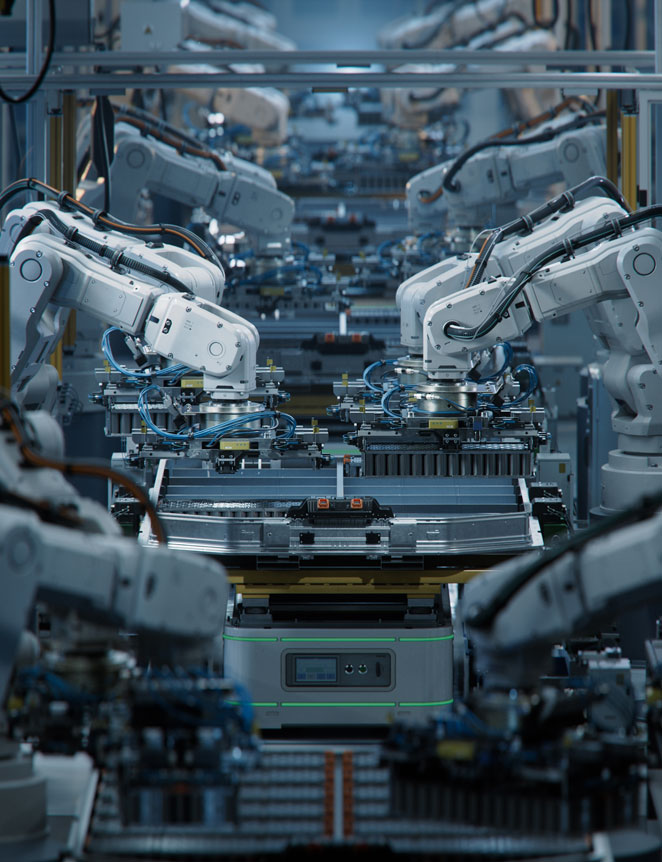

Groupack Holdings S.A. (“Groupack”) is the holding company of the buy-and-build platform in the packaging industry promoted by Marco Giovannini, Guala Closures former CEO and shareholder, and Claudio Giuliano, ex Carlyle and Bain Capital, which aims to become a leader in the mechatronics space

The platform currently includes 4 entities: (i) Bettinelli (automation solutions for assembly and testing lines), (ii) Union (extrusion lines), (iii) Alci (automation solutions), (iv) Neyret (index assembly lines), generating significant financial results (€130m revenues as of 31st December 2023 pro-forma)

PROCESS

Meti Corporate Finance supported the client in the fund-raising activities by approaching institutional investors and family offices in order to raise the necessary resources to support the buy-and-build project

In May 2024, Equilybra X and certain financial investors subscribed a reserved capital increase in exchange for approximately 20% of the shares of Groupack

The transaction closed in June 2024

OUT COME

The deal enables Groupack to obtain the financial resources to finance the ongoing acquisition campaign, pursuing an innovative “horizontal aggregation” project along the mechatronics space’s value chain